Select any text and click on the icon to listen! ByGSpeech

ByGSpeech

ByGSpeech

ByGSpeech ByGSpeech

ByGSpeech

Introduction

Green hydrogen is rapidly emerging as a key player in the global drive towards decarbonization, presenting an advantageous opportunity for GCC countries thanks to their abundant and affordable solar energy resources. While the region holds a cost advantage in green hydrogen production, the challenge lies in efficient transportation to lucrative markets, often doubling initial production expenses. The success of GCC countries in this arena hinges on refining supply chain processes to lower the overall cost of transporting green hydrogen. According to an analysis done by Strategy&, global demand for green hydrogen could reach 530 million tonnes by 2050, approximately 7% of primary energy consumption, significantly impacting oil equivalence.1 The Middle East is actively set, along with the Latin American and African regions, to produce over 4 million tonnes of electrolytic hydrogen by 2030, often for export purposes.2

Regional Capacities

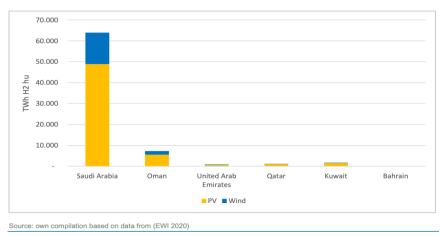

As of 2022, the technical capacity to generate green hydrogen in the GCC nations, as depicted in Figure 1 primarily relies on solar irradiation and wind speeds. However, this assessment does not encompass additional factors such as water availability, technological viability, socio-economic considerations, and ecological impacts. It's noteworthy that the predominant portion of the calculated potential stems from photovoltaic (PV) technology. Among the GCC nations, Saudi Arabia emerges with prominent overall renewable energy potential, notably emphasizing wind power as a significant contributing factor to its capacity potential.

Figure 1: Theoretical yearly production potential for green hydrogen by county3

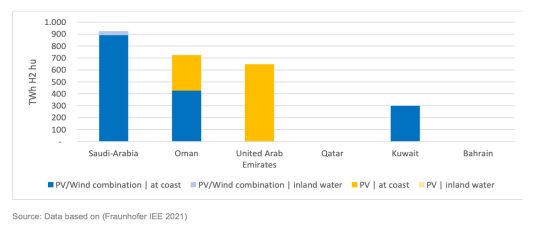

Figure 2 provides insight into the annual production potential for gaseous hydrogen, as detailed in the PtX Atlas created by the Fraunhofer Institute. Unlike the theoretical estimates depicted in Figure 1, the values here are notably lower. This discrepancy arises from a vital factor: the PtX Atlas focuses on areas with low water stress levels, designated by the World Resource Institute, as suitable for hydrogen production within their geographical analysis. The PtX Atlas also considers other critical aspects such as proximity to infrastructure, urban centers, coastlines, and export facilities, all influencing the results. This divergence underscores the transition from theoretical potential to a more refined export-oriented perspective.

Saudi Arabia, Oman, and the United Arab Emirates showcase robust production potential, ranging from 650 to 900 TWh of hydrogen. In contrast, Kuwait's potential is somewhat more moderate, at around 300 TWh. Notably, Qatar and Bahrain display no green hydrogen production potential within the PtX Atlas due to its differing focal points and political caution respectively.4 Saudi Arabia emerges with notable potential in combining photovoltaic and wind energy along the Red Sea coastline. Oman, similarly, shows a mix of potential driven by PV and wind combinations at coastal sites. In the United Arab Emirates, the potential primarily rests upon PV utilization along their coastlines. Meanwhile, Kuwait is anticipated to leverage combined PV and wind sources near the sea for their potential hydrogen production.

Figure 2: Annual potential for producing gaseous hydrogen5

Developments by Country

Bahrain

Export aspirations are notably absent from the data, while the prospects for blue hydrogen are primarily tethered to crude oil, if pursued at all. However, the absence of viable medium-term options for green hydrogen export is attributed to the lack of available renewable energy sources. Bahrain initially took a cautious approach to hydrogen development, conducting feasibility studies in November 2020 but refraining from active involvement. However, in January 2022, with the release of its Industrial Strategy 2022–2026, Bahrain officially embraced the goal of producing both green and blue hydrogen, signifying a shift towards active participation in hydrogen initiatives.6

Kuwait

The region is poised for near-term blue hydrogen exports, leveraging existing expertise and pioneering initiatives. This short-term trajectory aligns with the region's capacity to supply both blue and, in the long run, green hydrogen. The inclusive definition of blue hydrogen, encompassing carbon capture and utilization (CCU) alongside enhanced oil and gas recovery techniques, further underscores the diversified approach being undertaken.

Oman

While lacking a formalized hydrogen strategy, Oman has a host of upcoming projects in the pipeline. Exportation, serving as a substitute for conventional fossil gas exports, is poised to be a cornerstone, facilitated by existing LNG ports. The capacity for both short-term blue hydrogen and long-term green hydrogen solutions is within grasp, with a broader definition of blue hydrogen encompassing carbon capture and utilization and enhanced oil and gas recovery. Notably, initial exporting plans are directed towards non-EU nations. Despite the absence of a comprehensive strategy, there is a clear trajectory towards the integration of hydrogen especially Green hydrogen.

Qatar

The region is positioned for immediate blue hydrogen export due to past experience and early project initiatives. While the primary focus lies on blue hydrogen, the potential for green hydrogen exports in the midterm is constrained by the absence of significant renewable energy sources. Notably, the expansive definition of blue hydrogen, encompassing carbon capture and utilization as well as enhanced oil and gas recovery techniques, further underscores the diversity of strategies being explored.

Qatar takes a different approach compared to its Gulf neighbors when it comes to hydrogen. Qatar, as a major exporter of liquefied natural gas (LNG), does not have plans for a domestic hydrogen production policy. Instead, it focuses on leveraging its LNG exports to enable importers in other countries to produce blue hydrogen using the imported LNG. Qatar is actively building relationships with importers for this purpose and mentions hydrogen in its Nationally Determined Contributions (NDCs) as a means to fulfill its climate commitments.7

Saudi Arabia

Saudi Arabia is poised to become a significant player in the global hydrogen market, with plans to export green ammonia from the NEOM project by 2025. The country boasts immense potential for low-cost green hydrogen production, though its domestic demand is anticipated to fall short of the vast production capabilities. Benefiting from a shorter shipping distance to Europe via the Red Sea, Saudi Arabia is strategically positioned for hydrogen exports. Early efforts in hydrogen and ammonia projects, such as those in NEOM, have already commenced. While blue hydrogen remains a short-term possibility, the nation's focus is shifting toward long-term green hydrogen solutions. It's worth noting that the definition of blue hydrogen in the region is rather broad, encompassing carbon capture and utilization as well as enhanced oil and gas recovery. Environmental concerns surrounding seawater desalination call for research into zero-liquid discharge methods to mitigate the impact of brine disposal. However, due to the absence of pipeline transport options, shipping of ammonia, liquified hydrogen, or derivatives thereof is inevitable, leading to elevated landing costs at European ports. Unlike some other GCC countries, Saudi Arabia's natural gas infrastructure (pipelines and LNG harbors) is relatively less extensive, posing both challenges and opportunities for its hydrogen endeavors.

UAE

With a strong commitment to renewable energy uptake, the UAE is positioned to significantly contribute to the global hydrogen market, aiming to capture a remarkable 25% share by 2030. Collaborative efforts are underway as exemplified by the joint declaration of intent signed between the UAE and Germany in November 2021, signaling a shared interest in clean hydrogen and its derivatives.

The United Arab Emirates (UAE) has approved a new national hydrogen strategy with the goal of becoming one of the world's top green hydrogen producers. By 2031, the UAE plans to produce 1.4 million tonnes of green hydrogen per year, increasing this to 15 million tonnes by 2050. The strategy includes the development of two hydrogen production hubs by 2031, with three more planned by 2050. These hubs will reduce emissions in sectors such as heavy industry, transport, aviation, and sea freight. Additionally, the UAE aims to establish a green hydrogen research and development center by 2031 and increase renewable energy generation to 30% of the total energy mix by 2031.8

Conclusion

To remain competitive, GCC nations need to focus strategically on four imperatives. First, they

should reinforce their green hydrogen production cost advantage and invest in utility-scale solar

farms. Second, building green ammonia production plants closely integrated with hydrogen

generation facilities is crucial, coupled with securing substantial offtake agreements. Third, GCC

countries should intensify ammonia cracking efforts in key export destinations to reduce costs

through scale advantages. The fourth imperative is to establish integrated hubs that serve as centers

for both green hydrogen and ammonia production domestically and for reconverting ammonia into

high-purity hydrogen for export destinations. These hubs should leverage existing infrastructure,

fostering economies of scale and cost efficiencies across the hydrogen supply chain.9

* Dr. Mohamed Abdelraouf is the Environmental Security and Sustainability Research Program

Director at the Gulf Research Center & Asuka Nagasawa is a Master’s Candidate at Geneva

Graduate Institute

1 Ulrich Koegler and James Thomas, partners, and Susie Almasi, “The GCC’s green hydrogen opportunity,” Middle East business intelligence, January 11, 2021, accessed August 23, 2023, https://www.meed.com/gcc-green-hydrogenopportunity

2 IEA, “Global Hydrogen Review,” IEA, 2022, https://www.iea.org/reports/global-hydrogen-review-2022,

3 Christoph Heinemann, David Ritter, Roman Mendelvitch, and Kaya Dünzen, “Hydrogen Fact Sheet - Gulf Cooperation Countries (GCC),” February 28, 2022, accessed August 23, 2023, 14, https://www.oeko.de/fileadmin/oekodoc/GIZ-SPIPA-hydrogen-factsheet-GCC.pdf

4 Dawud Ansari, “The Hydrogen Ambitions of the Gulf States: Achieving Economic Diversification while Maintaining Power,”July 21, 2022, accessed September 8, 2023, doi:10.18449/2022C44

5 Christoph Heinemann, David Ritter, Roman Mendelvitch, and Kaya Dünzen, “Hydrogen Fact Sheet - Gulf Cooperation Countries (GCC),” February 28, 2022, accessed August 23, 2023, 14, https://www.oeko.de/fileadmin/oekodoc/GIZ-SPIPA-hydrogen-factsheet-GCC.pdf

6 Dawud Ansari, “The Hydrogen Ambitions of the Gulf States: Achieving Economic Diversification while Maintaining Power,”July 21, 2022, accessed September 8, 2023, doi:10.18449/2022C44

7 Dawud Ansari, “The Hydrogen Ambitions of the Gulf States: Achieving Economic Diversification while Maintaining Power,”July 21, 2022, accessed September 8, 2023, doi:10.18449/2022C44

8 Polly Martin and Rachel Parkes, “UAE targets 15 million tonnes of green hydrogen production by 2050 as it approves national H2 strategy,” Hydrogeninsight, July 4, 2023, accessed September 8, 2023, https://www.hydrogeninsight.com/policy/uae-targets-15-million-tonnes-of-green-hydrogen-production-by-2050-asit-approves-national-h2-strategy/2-1-1480383

9 Ulrich Koegler and James Thomas, partners, and Susie Almasi, “The GCC’s green hydrogen opportunity,” Middle East business intelligence, January 11, 2021, accessed August 23, 2023, https://www.meed.com/gcc-green-hydrogenopportunity