Select any text and click on the icon to listen! ByGSpeech

ByGSpeech

ByGSpeech

ByGSpeech ByGSpeech

ByGSpeech

The relationship between the Gulf Cooperation Council (GCC) countries and Latin America, encompassing 41 countries and territories from Mexico to Argentina and including the Caribbean Islands, has significantly evolved over recent decades, primarily driven by economic and commercial interests. In the 1970s and early 1980s, Brazil and Mexico fostered closer ties with Gulf nations, particularly due to Brazil's urgent need for oil supply, as it heavily relied on imports to fulfill 80% of its oil consumption. During this period, Brazil engaged diplomatically with Iraq, Saudi Arabia, Kuwait, and Iran, facilitating not only oil procurement but also trade in Brazilian products, including arms. Meanwhile, Mexico pursued a strategy of global positioning, prioritizing its presence on international platforms like the United Nations. Both regions shared common ground in supporting resolutions regarding the Arab-Israeli conflict, which further solidified their diplomatic relations.

In the early 2000s, GCC-Latin America ties were revitalized as both regions expressed a renewed commitment to strengthening relations through political exchanges and bilateral initiatives. Although Brazil had established initial contacts with the UAE and Qatar in the 1990s, it was not until 2000 that a systematic effort to enhance these ties gained headway. This effort involved Brazil’s establishment of a commercial mission in Dubai in 2002 and the beginning agreements across various economic sectors. The inaugural Summit of South American-Arab Countries (ASPA), convened by Brazilian President Luiz Inacio Lula da Silva (Lula) in 2005, was pivotal in bolstering relationships between Latin America and the Gulf. This heightened Brazil's significance in the Arab Gulf, culminating in the signing an Economic Cooperation Framework Agreement between the GCC and MERCOSUR. Talks for a free trade zone began in 2006 but have still not been concluded. After the ASPA inaugural summit in 2005, three additional summits were held: on 31 March 2009 in Doha, Qatar; on 1–2 October 2012 in Lima, Peru; and on 10–11 November 2015 in Riyadh, Saudi Arabia.

President Lula and Foreign Minister Celso Amorim were instrumental in taking this active approach, with Lula visiting multiple Gulf countries, including the UAE, Saudi Arabia, and Qatar from 2003 to 2005. These activities underscored Brazil's growing importance and influence in the Gulf region. However, this proactive engagement with Gulf nations declined during President Dilma Rousseff's term in office (2011-2016). Meanwhile, Mexico, under former President Felipe Calderon's administration, prioritized the Gulf as a strategic partner, a trend that has continued into the current administration of Andrés Manuel López Obrador (AMLO).

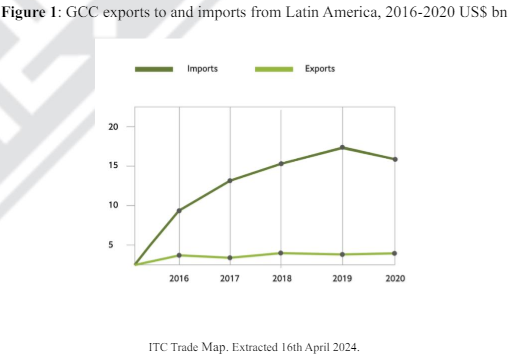

Despite facing connectivity limitations of geographical distance and a lack of cultural ties, the formal exchanges between the GCC and Latin America saw a notable surge in trade in the 2010s. Gulf states saw an increase in imports from Latin America, with significant contributions coming from Brazil, Mexico, Chile, and Argentina. By 2015, Argentina secured the second spot in trade among Latin American countries, closely trailed by Mexico in third place. Notably, Ecuador emerged as the fourth significant player in trade with Gulf countries through 2014-2015. Trade between Latin America and the GCC experienced significant growth (see figure 1), especially in imports, which notably increased from 2016 to 2019. During this period, imports into the GCC from Latin America increased substantially, rising from $9.6 billion in 2016 to $17.2 billion in 2019, before declining to $15.4 billion in 2020. These imports predominantly comprised primary goods, including gold, meat, iron ore, cereals, sugar, and coffee.

From 2016 to 2020, Gulf countries exported fertilizers, plastic polymers, aluminum, ammonia, and oil to Latin America with annual values ranging between 2.5 and 3.5 million USD. Conversely, GCC countries imported Latin American iron ore to manufacture aluminum, which was subsequently re-exported to the Gulf region.

Reflecting on investment dynamics, a report by the Dubai Chamber of Commerce reveals that the GCC countries have collectively invested an approximate sum of $4 billion in Latin America over the period from 2016 to 2022. The United Arab Emirates (UAE) contributed about 77% of these investments. The investments primarily targeted the logistics, distribution, and transport sectors. Notable acquisitions were made by the UAE's DP World, which operates several ports in Latin American countries including Argentina, Chile, Peru, and Ecuador. In 2023, Saudi Arabia’s Public Investment Fund (PIF) formed a multi-billion-dollar partnership with Patria Investments for a transport project in Brazil. They secured a 30-year concession for the capacity extension and operation of a new toll road project in Parana, Brazil. The project, part of a $1.2 billion capital expenditure investment, added 473km to Parana's existing toll highway system.

On the other hand, foreign direct investment (FDI) from Latin America to the GCC countries was less than $500 million from 2017 to 2021, a figure that is comparatively lower than in other regions. Although overall FDI from Latin America to the GCC is low, Brazil stands out as a key player, contributing approximately 85% of the total investment. The significant influence of Brazil is largely due to BRF, a major Brazilian food processing company known for its role as a leading poultry supplier in Gulf markets. BRF has made substantial investments in the region, including setting up food plants in Saudi Arabia and the UAE.

Established in the 1970s, BRF, particularly under the Sadia brand, has grown its presence by exporting high-quality meat products. In a move that solidified its standing in the Islamic markets, BRF established its GCC subsidiary OneFoods, formerly known as Sadia Halal, in 2016. As the leading global producer and exporter of halal meat, Brazil's role in the GCC's food security, and the Arab world more broadly, is critical. His Excellency Osmar Chohfi, the President of the Arab Brazilian Chamber of Commerce (ABCC), emphasizes this symbiotic relationship between Brazil and the GCC. “There is a complementarity in our bilateral trade, we provide food security to the GCC and the Arab world in general, and they provide us something indispensable for our agribusiness: fertilizers.” This reciprocal relationship underscores the broader narrative of trade relations between Latin America and the GCC.

Turning to trade, the most recent data from the International Trade Center's 2022 Trade Map indicates that the value of exports from GCC countries to Latin America amounted to $10.84 billion in 2022. These exports primarily comprised mineral fuels, mineral oils, products of their distillation, fertilizers, aluminum and related articles, plastics and related articles, and electrical machinery and equipment. In contrast, the total value of imports from Latin America reached $21.25 billion. These imports mainly included natural or cultured pearls, precious metals, meat, edible meat offal, ores, slag, ash, cereals, and sugars and sugar confectionery. As a result, the GCC countries faced a trade deficit of $10.41 billion with Latin America in 2022.

As of 2022, Brazil is the main trade partner for the GCC within Latin America, accounting for 61.61% of GCC exports and 50.01% of imports. However, the GCC has a trade deficit with Brazil, importing significantly more than exporting. Mexico and Argentina are the next significant trade partners after Brazil. Mexico contributes 11.58% to GCC's exports and 15.12% to imports, while Argentina contributes 10.98% and 10.52% to GCC's exports and imports respectively. Both countries, like Brazil, run a trade deficit with the GCC. Despite smaller trade volumes, Uruguay and Panama maintain a positive trade balance with the GCC. In contrast, Guyana relies heavily on the GCC for imports, with a high import value of $814.63 million compared to a relatively low export value of $13.56 million.

Despite a dip in trade dynamics in 2020 due to COVID-19, future trends in trade between the Gulf Cooperation Council (GCC) and Latin America continue to show promising signs of growth. Both regions are poised to leverage their strengths and deepen economic connections. While Brazil, Mexico, and Argentina currently serve as the main trade partners for the GCC, this could diversify as other Latin American countries increase their economic capacities and enhance their trade infrastructures. The growing interest of GCC in Latin America, demonstrated by investments from the UAE and Saudi Arabia, indicates a strategic focus on this region. This suggests a potential for increased trade ties and diversified investments, possibly leading to further investment in infrastructure and other sectors, which could boost trade volumes. However, it's crucial for the GCC to strive towards balancing their trade deficit. Additionally, the evolution of trade relations between the two regions will be contingent on geopolitical factors, economic policies, and the global economic climate. To navigate these promising yet relatively untapped markets, GCC economies can utilize their embassies and commercial attachés. Moving forward, by gathering market intelligence, facilitating information exchange, and promoting cross-border partnerships and investments, they can foster a more symbiotic and mutually beneficial trade relationship.

*Hannan Alghamdi is a Researcher at the Gulf Research Center