The Challenge in African countries

Africa has 60% of the world's uncultivated arable land. Agriculture accounts for 35% of Africa's GDP and employs more Africans than any other sector. According to the African Development Bank, Africa's food and agriculture market could increase from US$280 billion a year in 2023 to US$1 trillion by 2030. Despite the promising potential, several agriculture-based economies suffer numerous challenges.

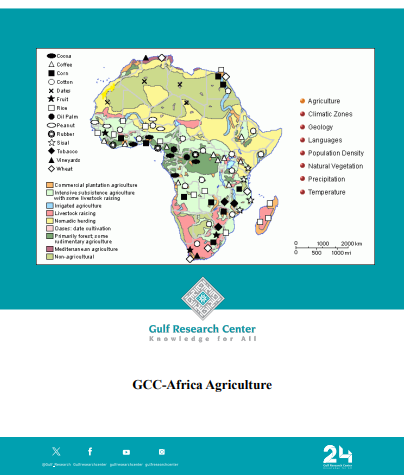

Africa’s Food Production:

In many regions, Africa has vast agricultural resources, with large tracts of uncultivated arable land, fertile soils, and favourable climates. It produces a range of key agricultural products:

Some countries, such as Nigeria, are large producers of cassava and yams, while Ivory Coast and Ghana are among the largest cocoa producers in the world. Ethiopia is one of the largest coffee producers globally. African countries are also a net importers of certain essential food items like wheat, rice, and vegetable oils, which contributes to food insecurity in certain regions.

Essential Products Africa Has a Surplus in:

Africa produces some agricultural goods in surplus, which could serve as an important export to GCC countries:

Challenges for African Agriculture

Despite its agricultural potential, Africa faces challenges that affect its food production capacity:

Development Areas

To maximize Africa’s agricultural potential and boost food security for both Africa and the GCC, several key improvements are necessary:

GCC Food Imports and Food Security Outlook:

The Gulf countries are heavily reliant on food imports due to their arid climate, water scarcity, and limited agricultural land. The GCC imports 80-90% of its food, making food security a key concern. To mitigate risks such as global supply chain disruptions and food price volatility, the GCC has sought strategic partnerships, especially with Africa, to secure its food supply.

GCC’s Food Security and Relations with Africa:

Africa has emerged as a key partner for the GCC due to its agricultural potential and proximity. The GCC countries have increasingly invested in African agricultural projects through land acquisitions, joint ventures, and agricultural investments. Countries like Sudan, Ethiopia, Nigeria, and others have attracted significant investment from GCC states, particularly in large-scale farming operations and livestock production. The investment in African agriculture is part of a broader strategy to diversify food sources, reduce reliance on global markets, and create a stable food supply chain.

As the GCC’s main food imports are rice and cereal, the figures below highlight which African countries produce the most products sought by Gulf states.

GCC-Africa Cooperation

According to the OEC, Saudi Arabia imported over 20 billion USD of food and agricultural products from African countries. Meanwhile, according to KSRelief, Saudi Arabia has contributed to 427 agricultural-related projects in 44 countries, totaling 2.5 billion USD, demonstrating that the Kingdom is an important ally in furthering Africa’s industrial development.

The UAE and Saudi Arabia jointly invested 400 million USD in Sudan’s agriculture. Furthermore, Saudi Arabia has contributed 3 billion USD to developing Sudan’s economy while increasing agricultural output. Following the Saudi Africa Summit, the Kingdom has increased agricultural engagements with Ghana, Senegal, Cote d’Ivoire, and Nigeria. Saudi Minister of Environment, Water, and Agriculture Abdulrahman Al Fadley held discussions with his African counterparts to enhance agricultural investments and food security.

According to the Saudi Development Fund’s 2023 Annual Report, in 2023, the Kingdom financed 34 Agricultural dams and irrigation systems, notably the Selenji Dam in Mali, Mauritania, Senegal, Burkina Faso, Niger, Sudan, and Chad, amongst others amounting to over 900 million USD. The Fund has made other significant investments over time, including cotton and sugar production in the Central African Republic, Somalia, Sudan, and Uganda, as well as funding further agricultural development projects in Uganda, Burkina Faso, Tanzania, Togo, and Guinea Bissau.

According to the OEC, the UAE imported over 38.8 billion USD of food and agricultural products from African countries. The UAE has consistently made efforts to secure agricultural resources in Africa through large-scale farmer investments, and food processing facilities.

The UAE has focused significant attention on Sudan as an International Holding Company, and Jennan currently farms over 50,000 hectares there. In 2022, IHC signed an agreement to develop an additional 162 000 hectares of land. In Uganda, the IAE is on course to build a 2 500-hectare agricultural free zone to process and ship food to the UAE, while Al Rawabi was granted 7 000 hectares for livestock production. Abu Dhabi-based ADQ has committed 500 million USD in Kenya for food production; meanwhile the UAE hopes to acquire agricultural land in Zambia as it is currently producing products in nearby Zimbabwe.

Other recent projects include a joint venture between Dubai Ventures and E20 Investment to build a large tract in Angola. Global Carbon Investments, a UAE-based firm, bought 7.5 million hectares of land in Zimbabwe for agricultural purposes. In 2023, EAP, another UAE agricultural company, planned to build a 200 million USD wheat farm project in Ethiopia.

According to the OEC, Qatar imported over 1.5 billion USD of food and agricultural products from African countries. Through Hassad Food, a subsidiary of Qatar Investment Authority, Qatar committed 500 million to Sudan’s agriculture. In Algeria, Qatar’s Baladna dairy company invested in large-scale agricultural projects to produce milk and meat. In 2024, Qatar won a 117,000-hectare concession to cultivate wheat in Algeria.

According to the OEC, Kuwait imported over 4.78 billion USD of food and agricultural products from African countries. According to the Kuwait Fund, Kuwait has financed over 45 agricultural projects in 21 African countries, most frequently in Sudan, Senegal and Mali.

According to the OEC, Bahrain imported 2.78 billion USD of food and agricultural products from Africa in 2022. Meanwhile, Oman imported 667 million USD.

Recommendations

There are significant opportunities to invest in Africa’s agricultural landscape as the African Development Bank estimates a 38 billion USD gap in financing per year in the industry. As the GCC countries aspire to diversify their economies and trading partners, there are ample opportunities for collaboration. The UAE, Saudi Arabia, Kuwait and Qatar have especially led these efforts by investing in agriculture by financing irrigation, dam projects, and processing facilities.

Furthermore, the GCC countries have invested in adjacent industries such as transportation, logistics and infrastructure to curb transport costs, making it less time-consuming and efficient. The initiatives the GCC countries take will help bolster agricultural production in African countries, and the surplus of the products could aid exports towards the Gulf States, a policy which Nestle has undertaken in the cocoa industry in Western Africa.