Select any text and click on the icon to listen! ByGSpeech

ByGSpeech

ByGSpeech

ByGSpeech ByGSpeech

ByGSpeech

In recent years, South Korea has sought to expand its influence in the Gulf region. Its active involvement is driven not by its alliance with the United States, but by its own security interests, marking a new direction in South Korean diplomacy. Looking ahead, South Korea may emerge as a significant external power in the Middle East.

This article explores South Korea’s Middle East policy, analysing the factors behind its deepening relations with the Gulf Cooperation Council (GCC) states. It also highlights the expansion of South Korea’s engagement in the region, moving beyond the economic and energy sectors to include military cooperation.

Section 1 provides an overview of South Korea-Gulf relations. Section 2 analyses the reasons behind South Korea’s growing energy dependence on Gulf states. Section 3 focuses on security cooperation as a notable trend in South Korea’s Middle East policy. Section 4 addresses the challenges in South Korea-Gulf relations. Finally, Section 5 considers the future prospects of South Korea-Gulf cooperation.

1- Overview of South Korea-Gulf Relations

During the Cold War, South Korea aligned itself with the Western bloc, led by the United States, and prioritized establishing relationships with pro-Western countries in the Middle East. As a result, building ties with the Gulf states was relatively straightforward. Between 1962 and 1980, South Korea established diplomatic relations with Saudi Arabia (1962), Qatar (1974), Oman (1974), Bahrain (1976), Kuwait (1979), and the United Arab Emirates (1980).

South Korea’s economic expansion into the Gulf region began in the 1970s. Following the 1973 oil crisis, South Korean construction companies significantly increased their presence as Gulf states used their newfound oil revenues to fund large-scale construction projects. South Korea, having already built substantial social infrastructure at home but facing declining domestic demand for construction, saw an opportunity in the Middle East. South Korean firms began securing contracts to build highways, ports, and factories across the Gulf. This trend continued into the 2000s when another surge in oil prices led to a renewed construction boom, further solidifying South Korean companies’ focus on the Gulf. By 2013, the value of construction orders secured by South Korean firms in the GCC countries exceeded half of all overseas contracts, amounting to approximately USD 17.3 billion.

One of the most notable South Korean projects in the Middle East is the Barakah Nuclear Power Plant in the UAE. In December 2009, Abu Dhabi’s Emirates Nuclear Energy Corporation (ENEC) awarded the contract to a consortium of South Korean companies. The Barakah project became a successful example of South Korea’s public-private partnership strategy in exporting infrastructure systems. Construction began in 2012, and the plant’s Unit 1 entered commercial operation in April 2021, followed by Unit 2 in March 2022, and Unit 3 in February 2023. According to the UK-based Energy Institute, the Barakah plant generated approximately 32 terawatt-hours (TWh) of electricity in 2023, accounting for 19.5% of the UAE’s total electricity output. On September 5, 2024, ENEC announced that Unit 4 had commenced commercial operations, raising the share of nuclear power in the UAE’s energy mix to an expected 25%. Nuclear power’s advantage lies in its zero CO2 emissions compared to thermal power generation, making the Korean-built Barakah plant a key contributor to the UAE’s decarbonization efforts and energy stability.

The trust built between the UAE and South Korea through initiatives like the Barakah nuclear project culminated in the signing of a Comprehensive Economic Partnership Agreement (CEPA) in May 2024 during UAE President Mohamed bin Zayed Al Nahyan’s visit to South Korea. Under the CEPA, the two countries plan to eliminate tariffs on approximately 90% of imported goods over the next decade. This agreement offers significant economic benefits for South Korea, as the removal of tariffs on key exports such as automobiles, home appliances, and agricultural products will open new opportunities for South Korean companies in the UAE market. Additionally, South Korea can leverage the UAE as a base for expanding trade into Africa and South Asia.

2. South Korea’s Energy Dependence on GCC Countries

South Korea’s proactive economic diplomacy in the Middle East is driven by its desire to reduce its current account deficit, which weakens its currency. As a country that lacks domestic energy resources, South Korea spends a substantial portion of its foreign exchange reserves on fuel imports. By encouraging the wealthy Gulf states to increase imports of South Korean goods and invest more in South Korea, the country aims to alleviate its current account deficit and improve its economic stability.

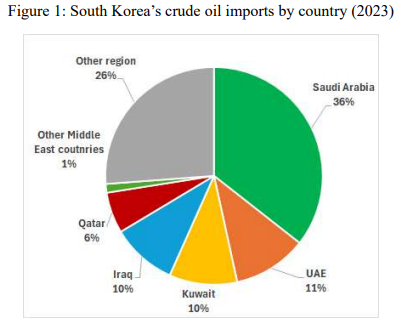

For South Korea, sourcing energy from the Gulf region is a national priority. Like Japan, South Korea imports the majority of its energy from this region, with a particularly high dependence on the GCC states for crude oil. According to data from the Korea International Trade Association, Saudi Arabia was South Korea’s largest crude oil supplier in 2023, accounting for 36% of total imports, followed by the UAE (11%), Kuwait (10%), Iraq (10%), and Qatar (6%) (see Figure 1). By increasing its imports of US crude oil from 2016, South Korea's dependence on Middle Eastern countries, including the GCC, fell from 87% to 73% between 2016 and 2023. However, South Korea still places importance on its energy relationship with the GCC countries.

South Korea’s increased reliance on crude oil imports from the GCC states in recent years has been driven in part by the deterioration of South Korea-Iran relations. After the implementation of the Joint Comprehensive Plan of Action (JCPOA) on Iran’s nuclear issue in January 2016, initiated by the U.S. under the Obama administration, South Korean President Park Geun-hye (in office from February 2013 to March 2017) became the first South Korean president to visit Iran. During her visit, she aimed to strengthen bilateral ties and secure additional Iranian crude oil imports. As a result, South Korea’s imports of Iranian crude more than tripled between 2015 and 2017, with Iranian oil accounting for 12% of South Korea’s total imports in 2017.

However, in 2018, following the Trump administration’s withdrawal from the JCPOA and the subsequent reimposition of sanctions on Iran, South Korea was forced to halt its imports of Iranian oil. In response, South Korea turned to the GCC states to compensate for the shortfall, increasing its crude oil imports from these countries.

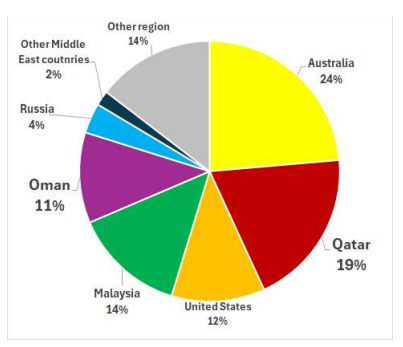

The GCC states are also playing an increasingly important role in South Korea’s natural gas imports. In 2023, Qatar ranked second, supplying 21% of South Korea’s liquefied natural gas (LNG), following Australia, which provided 24% of total imports. Oman was the fourth-largest supplier, accounting for 10% (see Figure 2). In recent years, South Korea has been seeking to increase gas imports from the Gulf as it transitions from coal-fired to gas-fired power generation to reduce greenhouse gas emissions. Additionally, it aims to secure alternative sources of gas following disruptions in its supply of Russian gas due to the Ukraine crisis.

After Russia’s invasion of Ukraine in February 2022, South Korea joined Western nations in imposing economic sanctions on Russia, including restrictions on exporting industrial machinery that could potentially be repurposed for weapons manufacturing. Russia, in turn, expressed its disappointment with South Korea’s actions and warned of the negative impact these sanctions would have on bilateral cooperation. As a result, South Korea is likely to further increase its gas imports from the Gulf states to compensate for the potential loss of Russian gas, which currently accounts for 4% of its total imports. This shift would significantly heighten South Korea’s dependence on the Gulf states for its gas supply.

Figure 2: South Korea’s natural gas imports by country (2023)

South Korea is actively supporting the LNG export activities of GCC countries by constructing LNG carriers for them. In recent years, both Qatar and the UAE have sought to significantly expand their LNG exports. Qatar, in particular, has been focused on expanding the North Field (NF) gas field (also known as the North Dome gas field) since 2017. This expansion will increase Qatar’s annual LNG production capacity from 77 million tons to 110 million tons by around 2026 with the completion of the first phase of the “NF East” project, and to 126 million tons by 2028 with the second phase of the “NF South” project. Additionally, the third phase, “NF West,” announced in February 2024, is projected to further increase production to 142 million tons by 2030, an 84% increase from current levels.

Similarly, the UAE approved the final investment decision (FID) for the Ruwais LNG project in Abu Dhabi in June 2024. This project includes the construction of a new LNG production facility at Ruwais Industrial City, with an annual capacity of 9.6 million tons by 2028. Once completed, the UAE’s total annual LNG production capacity is expected to rise to 15.6 million tons, more than doubling the current output.

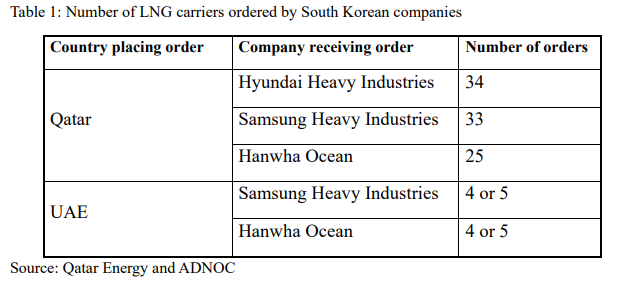

As the global LNG business expands, the demand for LNG carriers has also surged. In response, Qatar Energy, Qatar’s state-owned energy company, signed a slot reservation contract—an agreement that reserves dock space at a shipyard—for more than $3 billion with a Chinese shipbuilder, and for a total of $19.2 billion with three South Korean companies. Following these agreements, Qatar Energy signed long-term contracts to charter conventional LNG carriers (each with a capacity of 174,000 cubic meters) with 11 companies. All of these LNG carriers will be constructed by the three South Korean companies and one Chinese company under the reserved shipyard slots.

Likewise, the UAE’s Abu Dhabi National Oil Company (ADNOC) signed a $2.5 billion contract in July 2024 with South Korea’s Samsung Heavy Industries and Hanwha Ocean to build 8 to 10 LNG carriers. These contracts highlight South Korea’s crucial role in facilitating the expansion of LNG export capacity for the GCC countries.

As mentioned above, the procurement of new LNG carriers has been dominated by South Korean companies, with the majority of conventional carriers ordered by Qatar and the UAE (102 out of a maximum of 114) set to be built by Korean shipbuilders. In response to the GCC countries’ plans to increase LNG production, South Korea has actively promoted its LNG carrier production capacity and advanced technological capabilities to Qatar and the UAE. This proactive approach has played a key role in securing these shipbuilding contracts for South Korean companies.

3. South Korea-GCC Security Cooperation

A notable trend in South Korea-GCC relations has been South Korea’s increasing military involvement in the region. Historically, South Korean troops were deployed to the Middle East mainly at the request of its U.S. ally, such as during the 1991 Gulf War and the 2003 Iraq War, or as part of UN peacekeeping operations, including the UN Interim Force in Lebanon (UNIFIL) in 2006. However, since 2010, South Korea has begun to dispatch its military forces for its own strategic purposes.

First, the nuclear agreement between South Korea and the UAE marked the beginning of South Korea’s direct military involvement in the region, fostering ongoing military cooperation between the two countries. Since 2011, South Korean troops have been stationed in Abu Dhabi, where they train UAE special forces and provide protection for South Korean citizens in the UAE in case of emergencies.

Second, in response to a series of attacks on oil tankers in the Gulf of Oman near the Strait of Hormuz in 2019, South Korea expanded the operational area of its naval forces deployed in the Gulf of Aden to include the Strait of Hormuz. This was done to ensure the safety of South Korean nationals in the region and to secure freedom of navigation through the Strait, a vital route for energy shipments. As South Korea continues to strengthen its economic and energy ties with the GCC states, government support is crucial for its companies to operate safely in the Gulf region.

In addition to military cooperation, South Korea is seeking to establish a presence in the Gulf’s lucrative defense markets. The South Korean defense industry, positioned as a national strategic industry, plays a key role in both national security and economic growth. In 2022, a South Korean company signed a $3.32 billion contract with the UAE to export the Cheongung-II surface-to-air missile (SAM) system. Similarly, during a visit to Saudi Arabia by South Korean Defense Minister Shin in February 2024, the Korean Ministry of National Defense announced a $3.2 billion export contract for the Cheongung-II to Saudi Arabia.

Beyond the GCC countries, South Korean defense companies are expanding their footprint in the wider Middle East. In September 2024, South Korea’s largest defense firm, LIG Nex1, secured a $2.78 billion contract with Iraq to export the Cheongung-II medium-range surface-to-air missile defense system. This deal marked the third export contract for the Cheongung-II system, which is central to South Korea’s missile defense strategy, designed to intercept missiles and aircraft, particularly as a safeguard against threats from North Korea.

4. Obstacles to South Korea-GCC Relations

The ongoing South Korea-Iran conflict could pose a significant obstacle to further development of South Korea-GCC relations. In 2019, South Korea froze Iranian assets totalling approximately $7 billion in a Korean bank in response to U.S.-led sanctions on Iran. This action severely strained South Korea-Iran relations and fuelled growing anti-Korean sentiment within Iran. Iran responded by increasing pressure on South Korea to release the frozen funds. In January 2021, the situation escalated when Iran’s Islamic Revolutionary Guard Corps seized a South Korean-flagged tanker in the Gulf. Although the tanker was released in April of that year and both nations claimed the incident was unrelated to the frozen assets, it was clear that Iran’s frustration over the asset freeze was mounting.

Relations between the two countries were further strained when South Korean President Yoon Suk Yeol, during a visit to the UAE in January 2023, made a statement suggesting that South Korea’s security environment is similar to the UAE’s, implying that North Korea is to South Korea what Iran is to the UAE. Iran reacted strongly to this remark, making it more difficult to improve relations between Iran and South Korea.

While South Korea-Iran relations have deteriorated, there have been signs of easing tensions between the GCC states and Iran, particularly after Saudi Arabia and Iran agreed to normalize relations in March 2023. Stability in the Middle East is highly desirable for South Korean businesses operating in the region. However, Iran’s hostile stance toward South Korea and its longstanding military cooperation with North Korea remain serious concerns. Since the early 1980s, Iran has collaborated with North Korea on weapons development. If Iran views South Korea’s arms exports to the GCC states and Iraq as a direct threat, it may attempt to undermine South Korea’s defence industry or take other retaliatory measures to disrupt South Korea’s arms export activities.

5. Future Cooperation between South Korea and the GCC States

South Korea has established strong trust with the UAE and Qatar by successfully constructing a nuclear power plant and LNG carriers. Looking ahead, South Korea also seeks to deepen its cooperation with Saudi Arabia in these fields. Saudi Arabia plans to add 17 gigawatts (GW) of nuclear power generation capacity by 2040 to meet rising electricity demand while conserving oil and natural gas reserves. The Kingdom is already preparing to build its first two nuclear reactors toward this goal. In July 2024, South Korea secured preferential negotiation rights for a nuclear power plant expansion project in the Czech Republic, building on its successful experience in the UAE. Winning the contract for Saudi Arabia’s nuclear project would further bolster South Korea’s influence in the GCC states.

Another area of potential growth lies in Saudi Arabia’s plans for full-scale LNG production. In 2022, Saudi Arabia produced 120.4 billion cubic meters of natural gas, approaching Qatar’s production of 178.4 billion cubic meters (source: The Energy Institute). However, all of Saudi Arabia’s natural gas is currently used domestically, either reinjected into oil fields or allocated for power generation and industrial use. With Saudi Aramco aiming to begin gas exports by 2030, the country has taken steps by entering the LNG markets in the U.S. and Australia. This strategy enables Saudi Arabia to better manage its gas industry and align with global gas market trends. Should Saudi Arabia start exporting LNG, it would require LNG carriers, creating a valuable business opportunity for South Korean shipbuilders. Supporting this expansion, South Korea’s Hyundai Engineering & Construction and Hyundai Engineering signed a $2.4 billion contract with Saudi Aramco in 2023 to build a gas processing plant at Jafurah, Saudi Arabia’s largest unconventional non-oil-associated gas field, with reserves estimated at 200 trillion cubic feet (5.7 trillion cubic meters) of raw gas. Aramco estimates daily output could reach around 2 billion cubic feet by 2030 (source: Reuters).

Beyond energy cooperation, South Korea is working to expand its presence in emerging sectors such as hydrogen and electric vehicles (EVs) in Saudi Arabia. In October 2023, President Yoon Suk Yeol visited Saudi Arabia and Qatar to advance these efforts. During his visit to Saudi Arabia, President Yoon met with Crown Prince Mohammed bin Salman to discuss collaboration on hydrogen, smart cities, the defense industry, and startups. A key outcome was Hyundai Motor Company’s agreement with Saudi Arabia’s Public Investment Fund (PIF) to invest $500 million in establishing an EV manufacturing plant with an annual production capacity of 50,000 electric and gas-powered vehicles. This will be the first South Korean automobile factory in the Middle East, with PIF holding a 70% stake and Hyundai holding the remaining 30%. The two countries also launched the Hydrogen Oasis Initiative, which aims to strengthen partnerships and foster the development of clean hydrogen projects.

Through these initiatives, South Korea is positioning itself as a strategic partner for Saudi Arabia across both traditional energy sectors and emerging technologies.

Conclusion

After gaining independence, South Korea aligned itself with the Western bloc and initially established relations with the pro-American GCC states. Today, these countries have become essential economic and energy partners for South Korea. In recent years, South Korea’s energy dependence on the GCC states has deepened due to the suspension of Iranian oil imports under sanctions and the global shift toward decarbonization. This growing reliance has led South Korea to take independent military actions, such as stationing troops in Abu Dhabi and deploying forces to the Strait of Hormuz, to protect its companies operating in the Middle East and secure stable energy supplies from the Gulf.

By establishing a military presence in the Gulf, South Korea has demonstrated to the GCC states that it can also be a cooperative security partner. This defense cooperation has fostered trust between South Korea and the GCC states, which, in turn, will support South Korea’s state-led economic initiatives. This trust will be a critical factor in enabling South Korean companies to secure future business projects in the region.

*Noriko Suzuki is a Senior Advisor at the Gulf Research Center (GRC)

This research paper is closely completed with Mr. Masahide Takahashi, a researcher at the Middle East Institute of Japan (MEIJ)