The Democratic Republic of the Congo (DRC) is home to vast natural resources, including gold, cobalt, lithium, and coltan – all critical for global electronics and renewable energy industries. These resources have made the country a focal point of interest for global powers including the U.S., China, Russia, and throughout the Middle East. However, recent instability caused by several rebel groups threatens the Congolese government’s control over these assets and thereby the investment that global powers have made in securing them.

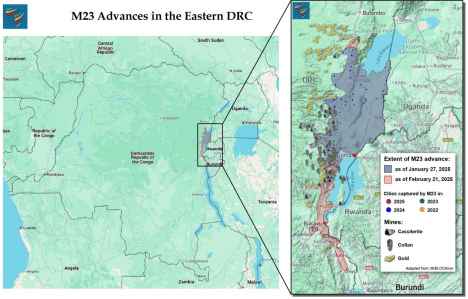

Tensions in DRC escalated between January and February 2025 when the M23 rebel group, backed by Rwanda, captured several cities in North and South Kivu – two resource-rich provinces in Eastern Congo. Goma, the capital of North Kivu, became the first major city to fall to rebel forces, resulting in 3,000 civilian deaths and the displacement of 500,000 people. The situation intensified when M23 seized Bukavu, the capital of South Kivu, and took control of the Kavumu Provincial Airport, a key military supply hub for Congo’s armed forces. The conflict has forced schools and businesses to close, caused civilians to flee, and has had adverse economic consequences for Congo, as Goma and Bukavu are vital trading hubs for its regional and international partners.

The latest advance in Bukavu, which borders Rwanda and Burundi, could potentially provoke a wider regional war. The Congolese forces have relied on support from Burundi, Uganda, and South Africa who have deployed soldiers and equipment to deter advances of rebel groups. However, the resolve, skill, and discipline of the Rwandan-backed M23 appear to be superior to that of their adversaries as the Congolese army withdrew from the South Kivu province and its governor fled following M23 gaining ground in Bukavu. 2 According to the United Nations, Rwanda has deployed 4,000 troops and weapons to support the rebels, which aggravates the threat of a regional conflict.

In early February 2025, the Southern African Development Community and the East African Community held a summit in Tanzania attended by leaders from Angola, Burundi, Kenya, Rwanda, South Africa, Uganda, Zimbabwe, and Zambia to attempt to resolve the crisis. The following week, the African Union hosted a Peace and Security Summit in Ethiopia; however, Congolese President Felix Tshisekedi did not attend either summit, unlike Rwandan President Paul Kagame.3 Despite calls for a ceasefire, the hostilities have continued, with M23 advancing further into Eastern Congo and threatening to expand its campaign to Kinshasa, Congo’s capital.

Tensions between Rwanda and the DRC have deep historical roots. The 1994 Rwandan genocide led to mass displacements, with many Hutu militias seeking refuge in Congo. Kigali has long accused Kinshasa of harboring Hutu rebels, particularly the Democratic Forces for the Liberation of Rwanda, which it claims pose a security threat. The M23 claims to defend the rights of the minority Tutsi in Congo; however, since seizing control of Rubaya in North Kivu last year, the rebels have smuggled tonnes of coltan to Rwanda and taxed miners and traders.4 Therefore, Rwanda has also faced accusations of exploiting Congo’s mineral wealth through its support of M23 - allegations that President Kagame has denied.

At the Munich Security Conference, President Tshisekedi decried Western powers for failing to impose sanctions on Rwanda, which benefits significantly from international aid. In parallel, leaders from other African countries have questioned Tshisekedi’s reluctance to hold talks with the rebels as some believe it would be the most viable path to a resolution.

Challenges and Opportunities for Gulf States

For the Gulf states, the conflict in Congo holds other implications. In connection with their economic diversification strategies, the GCC states have deepened their engagement with Africa, both diplomatically and strategically. Saudi Arabia’s Vision 2030, for example, strives to bolster its renewable energy production, including ramping up electric vehicle production. Similarly, the UAE prioritizes using its oil-borne wealth to gain minerals essential for power transmission lines, electric cars, and renewable energy. As stated above, there is a new impetus for critical minerals which North and South Kivu provinces are renowned for.

In addition, while Chinese companies have long held a monopoly over Congo’s critical mines, President Tshisekedi has aimed to deter such Chinese influence by attracting Saudi investments.5 These reaffirm commitments made during the Future Minerals Forum (FMF) held in 2024 when Saudi Arabia announced its plan to purchase 15 billion USD in global mining stakes and secure minerals from the DRC and other mineral-rich economies. At the FMF, the Kingdom signed an MoU with Congo for mining investments, and at the Mining Indaba 2025 in Cape Town, an official from the Saudi Ministry of Industry and Mineral Resources declared that developing mineral corridors across the continent is a top priority, as is having a secure supply of minerals for the energy transition.

The UAE’s Foreign Ministry has expressed “deep concern” over the developments in Congo and advocated for “peace and stability” to return to the region7 as it holds financial interests there, including a joint venture between DP World and Congo to build a deep-water port on the Atlantic shore. In addition, it has made other infrastructure and security investments, notably by supplying armored vehicles to the military, in order to protect its assets. International Holding Co., a UAEbased conglomerate controlled by the ruling Al Nahyan family, has shown interest in purchasing a tin mine in North Kivu, yet the current developments make it a challenge to realise these ambitions.

In addition to Congo, the GCC has also developed ties across the African Great Lakes region. In February, the Federation of Saudi Chambers (FSC) and the Rwanda Private Sector Federation.

established a joint Saudi-Rwandan Business Council to boost economic cooperation in mining, tourism, and construction.9 Since 2023, the UAE has been Rwanda’s largest trading partner, with trade exceeding 1 billion USD, while the UAE’s private sector has invested over 320 million USD in Rwandan technology, energy, agriculture, and mineral processing.10 In 2024, the two countries established a Joint Economic Committee to strengthen investments in industry, energy, and education, 11 and Qatar Airways acquired a majority share of RwandAir and the Burgessa International Airport to increase its access to African markets.

Qatar’s Foreign Ministry expressed great concern for the situation in the Congo as it looks to bolster its economic ties.12 President Tshisekedi held a bilateral discussion with Qatar’s Emir Sheikh Tamim bin Hamad Al Thani to steer more investments into mining, communications, and cybersecurity. 13 However, the Emir stressed that Congo must have a favorable business climate to support Qatar’s initiatives; therefore, returning order throughout the country remains a key priority.14 Stability in the DRC and Rwanda is crucial for these investments to materialize, as the ongoing conflict threatens mining operations, supply chains, and foreign investments.

While African-led diplomatic efforts have yet to yield a resolution, the GCC and its member states could emerge as critical stakeholders with interests in both Rwanda and the DRC. Gulf nations have previously played key roles in mediating conflicts in Africa, such as the peace accord between Eritrea and Ethiopia, and the conflict in Sudan. In 2023, Qatar tried to broker peace accords between Kigali and Kinshasa, and although unsuccessful, the commitments remain undeterred. In January 2025, President Kagame held talks with French and Qatari officials to negotiate a peaceful resolution, and in February, Qatar’s Minister of State for Foreign Affairs, Mohammed Al Khulaifi, met with President Tshisekedi to reaffirm Qatar’s commitment to stability in the African Great Lakes region.

The bottom line is that any prolonged instability threatens to disrupt extraction and exportation processes, making it difficult for the Gulf to access the critical minerals it seeks. Given their economic leverage and diplomatic efforts in Africa, the Gulf states have the potential to play a crucial role in calming tensions and promoting peace and stability in the region. By engaging in diplomatic mediation, supporting security initiatives, and leveraging their influence in international organizations, they can thus contribute to conflict resolution while safeguarding their own economic interests.

*Michael Wilson is a Researcher at the Gulf Research Center (GRC).

--------------------------------------------------

1 Brewer, Cecily “A DRC-Rwanda Truce Is Key for African and U.S. Interests — Here’s How to Get There.” United States Institute of Peace February 7, 2025

2 Flanagan, Jane “M23 Rebels in DR Congo Seize Mineral-Rich City as Soldiers Flee.” The Sunday Times February 17, 2025

3 Vivianne Wandera “As the DRC Battles Rwanda-Backed M23, What’s Needed to Stop the Fighting?” Al Jazeera February 13, 2025

4 Toulemonde, Marie“DRC-Rwanda: Rubaya Coltan Mine at the Heart of M23 Financing.” The Africa Report February 6, 2025

5 Magid, Pesha “Congo Courts Saudi Mining Investors to Help Curb China Dominance.” Reuters, January 14, 2025

6 “Vice Minister for Mining Affairs Calls for Stronger Collaboration to Build Africa’s Mineral Infrastructure at Mining Indaba 2025” Saudi Press Agency February 9, 2025

7 “UAE Expresses Concern over Situation in Democratic Republic of Congo” UAE Ministry of Foreign Affairs January 29, 2025

8 Clowes, William “Abu Dhabi’s IRH Explores Investing in Alphamin’s Congo Tin Mines.” Bloomberg November 18, 2024